What’s Inside the World’s Largest Rural Broadband Network?

In the world’s largest rural broadband rollout connecting 6,50,000 villages, HFCL supports 60 percent of network routing.

FE BFSI delivers comprehensive coverage of India’s dynamic banking, financial services, and insurance (BFSI) sector. It offers sharp news updates, deep-dive stories, expert interviews, and analysis tailored for industry professionals, policymakers, investors, and decision-makers.

With a strong focus on B2B narrative, the section tracks key developments in banking trends, credit growth, fintech innovation, and evolving regulatory frameworks from RBI, SEBI, IRDAI, and other financial bodies. It also explores critical themes such as macroeconomic linkages, financial inclusion, and leadership strategies shaping the sector’s future.

What’s Inside the World’s Largest Rural Broadband Network?

In the world’s largest rural broadband rollout connecting 6,50,000 villages, HFCL supports 60 percent of network routing.

Vivriti Capital Transforms its Lending Platform with IBM API Connect

Vivriti Capital has adopted IBM API Connect on AWS to modernize its lending infrastructure, reducing onboarding cycles by 60–70% and lowering overall technology costs through automation and centralized API management.

Actuarial Leaders to Gather for 25th Global Conference; Focus on Managing Risks for Inclusive Growth

The theme Actuarial Pathways to Viksit Bharat: Managing Risks for Inclusive Social and Economic Growth will include talks around areas viz., expanding insurance, pension coverage, managing climate-linked risks, strengthening financial resilience and more.

How an 11.2mm Cable Solved a $65 Billion Infrastructure Problem

Civil works represent the single largest cost component in fiber network deployment, typically accounting for 60-80% of total project expenses.

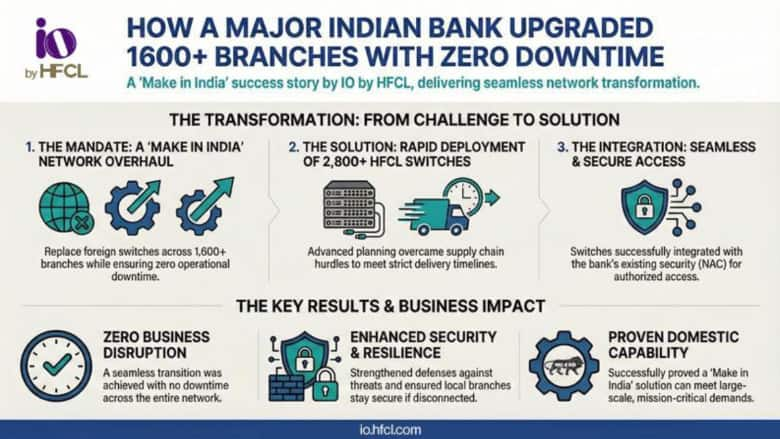

How a Bank Replaced 2,800 Foreign Switches Across 1,600 Branches

The switches seamlessly integrated with the bank’s existing infrastructure, ensuring uninterrupted connectivity while upholding stringent security measures for core systems

Shark Tank Famed ScrapUncle Raises ₹22 Crore

The fresh capital will help the company fund its Delhi NCR expansion and scale operations towards ₹100 crore ARR.

Intelligent Finance: Empowering Finance Leadership with Predictive Insights and Automation

From cautious explorers to believers in a tech-led transformation, and even those keen to learn from the experiences of others, there was little doubt that organisational and societal gains could be accrued when CFOs opted to focus on decision-making armed with predictive insights in the AI era.

How AI Builds Efficiency for Smarter Decision-Making Across Finance and Marketing

The fundamental challenge, repeatedly highlighted, is the state of the data itself. Professionals stressed the "garbage in, garbage out" principle, noting that integrating disparate legacy ERP systems into a unified data lake or unified database is a hurdle.

Sportstech fund Centre Court Capital Closes Maiden Fund at Rs 410 crore

The fund is anchored by Parth Jindal, who leads JSW Group’s cement and paint business, and is backed by domestic institutional investors, including SIDBI and the government’s Self-Reliant India (SRI) fund as well as family offices such as Premji Invest, SanRaj Group and GMR Sports.

Kanika Garg: Personal Story, From Struggles to Success

For Kanika, it’s the struggles, not just the success, that have shaped her: “It was the challenges along the way that truly shaped me—making me resilient, grounded, and deeply empathetic as a leader. The support of my parents and partner keeps me going.”

Preventive Vigilance Vital for PNB's Progress with Strong Governance: MD Ashok Chandra

Observing the bank’s Vigilance Awareness Week, Chandra said PNB remains focused on driving qualitative, sustainable, and inclusive growth.

Agriculture’s Next Leap is Tech-Driven Precision Insurance: AIC CMD

Agriculture Insurance Company's CMD Dr Lavanya R. Mundayur tells FE BFSI that the future of agricultural insurance lies in integrating real-time satellite analytics, weather data, and tech-based yield assessment to ensure that insurance products evolve dynamically with climatic and market realities.

BII Partners with Impact Investor BlueOrchard for new $250M Fund to Tackle Climate Emergency in Emerging Markets

BlueOrchard is working to secure investments from insurance providers in the senior notes tranche and other commercially and impact-minded investors in the senior and junior equity tranches with the aim of a final close targeting more than $250 million.

Meera Parthasarathy: Pioneering Leadership in Indian Insurance

Meera’s expertise is both deep and broad, having worked across major cities including Indore, Trivandrum, Bangalore, Chennai, Faridabad, and Delhi. Her career progression reflects a mastery of diverse domains—from fire and engineering to motor, health, accounts, and human resources.

Expanding coverage to rural areas is urgent: R K Gupta, GM, Oriental Insurance Company

After an intensive induction at Oriental’s Staff Training College in Faridabad, Gupta's early assignments gave him a solid foundation. “Working in diverse departments like Loss Control and Reinsurance taught me the essence of risk and operational management,” he says.

Ajai Kumar Tripathi: Steering Aviva India with Prudence, Trust, and Innovation

Tripathi’s professional journey began with LIC, India’s largest life insurer. Over 25 years, he has navigated the technical, regulatory, and leadership aspects of the insurance industry, gaining deep insight into actuarial science, financial governance, and compliance.

Redefining Underwriting Excellence: The Leadership Journey of Biji Samuel

Her professional journey is marked by a steadfast commitment to future-ready practices, technological innovation, and a deep understanding of risk—especially in the spheres of underwriting management, new business automation, reinsurance administration, and mortality risk investigations.

Tata Capital to Draw $16 Million Revolving Facility From GCF to Back Climate-Tech Startups

As a revolving finance, Tata Capital will reinvest that money to fund new ventures, ensuring the support continues for years to come.

Mukul Jain: Redefining Insurance Through Technology and Trust

With over 24 years of experience across technology, financial services, and insurance, including more than 16 years as a CIO or Regional CIO, Jain has consistently focused on aligning technology with business strategy and customer outcomes.

Karthik Chakrapani: Bridging Purpose and Innovation at Pramerica Life

Since rejoining Pramerica Life in 2021 as Chief Business Officer, Karthik has focused on expanding distribution, driving digital transformation, and enhancing customer experience, while staying true to the ethos of safeguarding lives with empathy and customer-centricity.

Empower your business. Get practical tips, market insights, and growth strategies delivered to your inbox

By continuing you agree to our Privacy Policy & Terms & Conditions