The switches seamlessly integrated with the bank’s existing infrastructure, ensuring uninterrupted connectivity while upholding stringent security measures for core systems

India recorded nearly 114 billion digital transactions in FY23, with digital banking users projected to surpass 3.6 billion by 2024—a 54% surge from 2020 levels. Yet behind this exponential growth sits a critical infrastructure question most bank boardrooms are grappling with: How do you modernize mission-critical network hardware across hundreds or thousands of branches without risking even a minute of downtime?

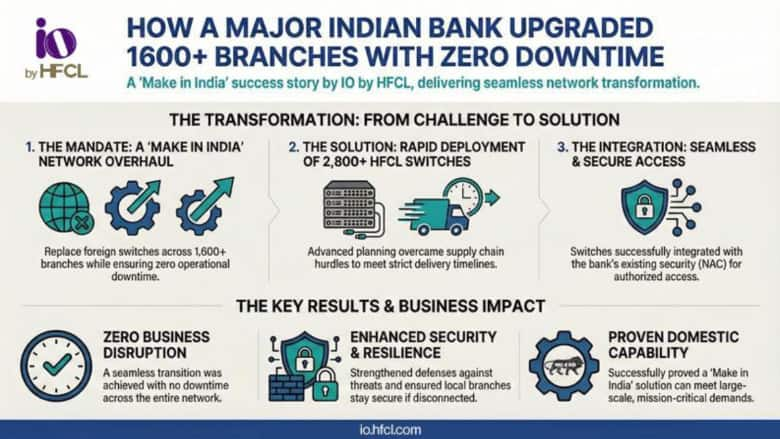

For one of India's oldest public sector banks—established in 1908 and processing over 604 million UPI transactions monthly—the challenge was particularly complex. The institution needed to comply with government mandates to transition from foreign network switches to Make in India alternatives, but with no proven track record of indigenous switches deployed at this scale, the risk profile was significant.

The Make in India dilemma facing PSU banks

Government directives to prioritize domestic manufacturing create strategic and operational imperatives for public sector financial institutions. Yet transitioning core network infrastructure components carries risks that can directly impact:

Transaction continuity across branch networks handling millions of daily customer interactions

Security posture, particularly integration with existing Network Access Control (NAC) systems designed for foreign OEM protocols

Regulatory compliance, where any service disruption during a migration can trigger scrutiny

Supply chain reliability, especially given the global chipset shortage that had strained OEM delivery timelines

The bank's technical team faced three compounding concerns: whether domestically manufactured switches could match the performance of incumbent foreign vendors, whether a large-scale deployment (2,800+ units) could be executed within tight timelines during a global chip crisis, and critically, whether the transition could happen without business interruption.

Engineering a zero-risk migration at national scale

HFCL's approach centered on advance planning of critical components and phased deployment architecture designed to eliminate transition risk across the bank's 1,600+ branch footprint.

Supply chain resilience

Despite global chipset constraints, HFCL pre-positioned inventory and component sourcing to deliver 2,800 fully managed 24-Port Layer 2 switches within the prescribed timeline—proving domestic OEMs could match or exceed foreign vendor delivery SLAs.

Seamless NAC integration

Rather than requiring the bank to reconfigure its existing Network Access Control infrastructure, HFCL switches were engineered to integrate natively with the incumbent NAC system, ensuring only authorized devices maintained network access during and after migration.

Branch-level resilience architecture

A critical differentiator: local security capabilities built into each switch ensured that even if a branch temporarily disconnected from the central system, operations continued securely at the branch level—eliminating single points of failure.

Balanced capacity design

The 24-Port configuration provided optimal scalability within physical space constraints, accommodating computers, printers, and POS terminals, while allowing headroom for future digital banking expansion.

What zero-downtime execution delivers

The deployment achieved three outcomes that matter most to banking operations:

|

Dimension |

Result |

Business Impact |

|---|---|---|

|

Migration execution |

Zero downtime across 1,600+ branches |

No transaction interruptions, no customer service degradation, no regulatory exposure |

|

Security posture |

Seamless NAC integration + local branch security |

Enhanced cyber defense and continuous compliance even during central system disruptions |

|

Operational continuity |

Branch-level resilience during network events |

Maintains transaction processing and customer service independent of central connectivity |

"These switches seamlessly integrated with the bank’s existing infrastructure, ensuring uninterrupted connectivity while upholding stringent security measures for core systems," notes Anand Kumar, Vice President IO by HFCL. "This strategic deployment enabled the bank to navigate the transition flawlessly."

Why execution matters more than specification

The difference between a successful network infrastructure migration and a costly disruption rarely comes down to product datasheets. What separates outcomes is:

Pre-deployment planning

HFCL's ability to forecast component needs, secure supply chains, and pre-test integration protocols before branch-level deployment eliminated the trial-and-error risk typical of large-scale rollouts.

Phased execution discipline

Rather than attempting simultaneous replacement, the deployment was choreographed branch-by-branch to contain risk, validate performance, and maintain fallback options at every stage.

Post-deployment resilience

Local security features and authentication mechanisms ensure the network maintains integrity even during unforeseen central system events—critical for geographically distributed branch operations.

For PSU banks managing similar transitions under Make in India mandates, this case study establishes a replicable playbook: large-scale indigenous hardware deployments can be executed with institutional-grade reliability when backed by rigorous planning, phased implementation, and resilience-first architecture.

The HFCL infrastructure advantage

HFCL has emerged as the domestic alternative for banks requiring both Make in India compliance and mission-critical reliability standards. The company's end-to-end capabilities—from supply chain management through deployment execution to post-installation support—mirror the full-service models previously available only from foreign OEMs, but with the regulatory alignment and cost structures PSU institutions require.

With India's digital payment infrastructure scaling exponentially and government procurement policies increasingly favoring domestic manufacturing, financial institutions need network partners who understand both the technical demands of 24/7 transaction environments and the execution discipline required to modernize without disruption.

Disclaimer: This article contains sponsored content that may not reflect the independent opinion or views of FinancialExpress.com. Further, FinancialExpress.com cannot be held responsible for the accuracy of any information presented here.

Empower your business. Get practical tips, market insights, and growth strategies delivered to your inbox

By continuing you agree to our Privacy Policy & Terms & Conditions