Slowing credit growth, shifting liability dynamics, and pressure on net interest margins (NIMs) due to a changing monetary environment are among key risks, according to the Reserve Bank of India.

As of March 2025, the gross non-performing asset (GNPA) ratio in unsecured retail loans stood at 1.8 per cent, higher than the overall retail GNPA of 1.2 per cent. (Source: financialexpress)

India’s banking sector, while having delivered robust performance over the past three years, may face mounting near-term pressures. Slowing credit growth, shifting liability dynamics, and pressure on net interest margins (NIMs) due to a changing monetary environment are among key risks, according to the Reserve Bank of India.

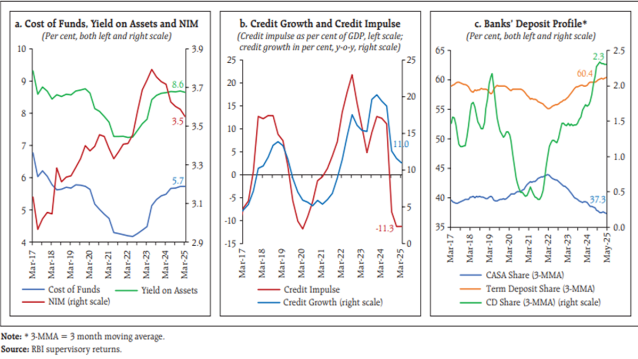

The central bank, in its latest financial stability report, noted that with an increasing share of loan books now linked to the external benchmark-based lending rate (EBLR)—which is adjusted more frequently in line with repo rate movements—a softening rate cycle could compress NIMs.

At the same time, the growing share of term deposits, which carry fixed rates and change less frequently, could add to the impact. However, the recent 100 basis point cut in the Cash Reserve Ratio (CRR) is expected to partially offset this pressure by releasing liquidity and lowering banks’ costs.

Also read: NBFCs see Sharp Slowdown in US Education Loans, Turn to New Markets: Crisil

Another concern flagged by the RBI is the deceleration in credit growth from around 17 per cent as of March 2024 to 11 per cent as of March 2025 and a negative credit impulse at minus 11.3 per cent (of GDP) from positive around 12 per cent as of March 2024, signaling weakening demand for loans amid heightened economic uncertainty. A slowdown in the broader economy could further suppress credit uptake, with potential implications for both asset quality and profitability.

Additionally, the composition of bank liabilities is undergoing a structural shift. The share of higher-cost term deposits and certificates of deposit (CDs) is rising, replacing traditionally cheaper current account and savings account (CASA) deposits.

The report also underscored emerging risks in the unsecured retail lending segment. While post-pandemic credit growth had been fuelled by retail and NBFC lending, the RBI’s tightening of risk weights on certain segments of consumer credit and NBFC exposure has led to a sharp deceleration in these segments. Unsecured retail loans now form 25 per cent of total retail loans and 8.3 per cent of gross advances, with asset quality in this pocket weakening compared to overall retail portfolio.

As of March 2025, the gross non-performing asset (GNPA) ratio in unsecured retail loans stood at 1.8 per cent, higher than the overall retail GNPA of 1.2 per cent, with private sector banks (PVBs) contributing 52.6 per cent to slippages. Write-offs also remain a major contributor to NPA reduction in this segment, especially among PVBs.

Also read: Q1 Preview: NBFCs' growth to remain fairly strong, margins to remain steady

While banks remain well-capitalised, with strong CET1 (common equity tier 1) capital buffers and improved earnings, the RBI has signalled the need for continued vigilance as pockets of stress emerge, particularly in unsecured lending and public sector bank portfolios where early signs of strain such as a rise in special mention accounts (SMAs) are visible.

As of March 2025, gross advances of scheduled commercial banks stood at Rs 181 lakh crore, growing from Rs 163 lakh crore as of March 2024 while gross NPAs dropped to 2.3 per cent from 2.8 per cent. The Capital to Risk-weighted Assets Ratio (CRAR) increased to 17.3 per cent from 16.8 per cent, according to the report.

Empower your business. Get practical tips, market insights, and growth strategies delivered to your inbox

By continuing you agree to our Privacy Policy & Terms & Conditions