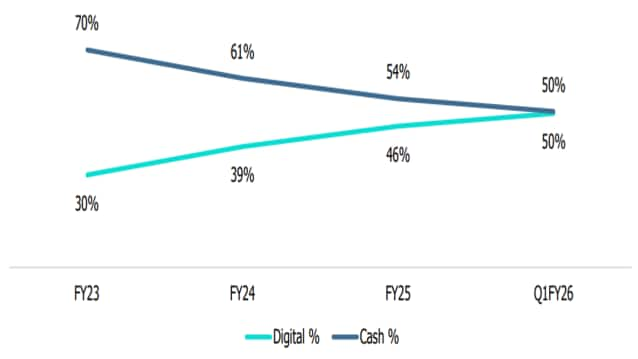

Cash usage in Private Final Consumption Expenditure (PFCE) is estimated to have dropped to a 50 per cent share during the first quarter of the current financial year, while the share of digital transactions has increased to 50 per cent.

Despite the rise of a digital-first economy, cash remains a vital component of the payment system. (Source: AI Image)

Cash usage in Private Final Consumption Expenditure (PFCE) is estimated to have dropped to a 50 per cent share during the first quarter of the current financial year from 54 per cent during the entire FY25 and 61 per cent during FY24, said CareEdge Advisory on Monday. Despite the rise of a digital-first economy, cash remains a vital component of the payment system due to its reliability, inclusivity, and widespread accessibility, especially in rural and informal sectors.

Moreover, it serves as a crucial fallback during crises, such as natural disasters or system failures, when digital payments are not feasible. Furthermore, cultural practices and established trust in physical currency ensure its enduring relevance, the advisory firm said.

Therefore, while digital payments are growing, cash remains deeply embedded in the consumption cycle, supporting continuity, particularly during economic shocks and ensuring a hybrid and resilient payment ecosystem.

Also read: Fintech and Billion-Dollar Deals Drive Resilience in Q3 for Financial Services: Report

According to the data shared, the share of digital transactions in PFCE increased from 30 per cent in FY23 to 50 per cent in Q1 FY26, driven by UPI adoption, policy changes, and evolving consumer behaviour.

The current 50:50 split between the share of digital transactions and cash in private consumption represents a tipping point, suggesting that the digital segment has substantial headroom for growth. However, cash will persist as a complementary asset.

Share of cash and digital payments in PFCE (Source: CareEdge Advisory)

Cash's continued relevance is also attributed to its role in personal budgeting as well as its function as a hedge against systemic risks such as cyberattacks.

Importantly, retail payments are now 99.8 per cent digital with paper-based instruments (cheques) nearly obsolete, owing to policy push, infrastructure support, and deep fintech penetration.

The driving force behind this behavioural shift of growing digital transactions is Unified Payments Interface (UPI), with 54.9 billion transactions in Q1 FY26 and 185.9 billion transactions in FY25. UPI transactions grew at a CAGR of 49 per cent between FY23 and FY25, underscoring rapid adoption and deepening penetration in tier 2 and tier 3 cities.

Also read: India Rises to 3rd Spot in Global Fintech Ecosystem Even as Funding Dips 17% in 9M 2025

While UPI leads digital payments, other systems such as NEFT, IMPS, and NACH also remain important, especially for high-value and bulk payments. For instance, NEFT remains crucial for mid-to-high-value transactions with an average ticket size of approximately Rs 48,000 as of Q1 FY26, which is significantly higher than that of UPI.

IMPS, on the other hand, continues to experience steady growth but is being cannibalised by UPI, which offers a similar instant payment experience with broader merchant acceptance. Further, NACH transactions remain important for bulk disbursements, such as salaries, subsidies and dividends.

Empower your business. Get practical tips, market insights, and growth strategies delivered to your inbox

By continuing you agree to our Privacy Policy & Terms & Conditions